Family Class: Assessing the Sponsor

For family class categories where MNI requirements must be met, a sponsor cannot be found eligible if they fail to meet MNI, even if they (and the co-signer, if applicable) have good employment prospects, considerable assets or other family members willing to provide additional support.

Application of the temporary public policy on minimum income requirements in 2020

The Temporary public policy concerning applications for permanent residence as a member of the family class whose sponsor must meet a minimum income requirement in 2020 exempts certain permanent residence applicants from the requirement that their sponsor (and co-signer, if applicable) meet all of the requirements of the Immigration and Refugee Protection Regulations (IRPR) for the 2020 taxation year.

This public policy came into effect on October 2, 2020, and will end once no longer applicable.

Affected applications

This public policy applies to the processing of all family class applications for permanent residence where the applicant’s sponsors must meet an income requirement when 2020 income is assessed. This may include

- parents and grandparents applications received between January 1, 2021, and December 31, 2021

- parents and grandparents applications received after December 31, 2021, for which 2020 income is assessed

- any family class applications received prior to January 1, 2021, for which an officer has initiated a financial re-assessment

- family class applications that are subject to an income assessment 12 months prior to the date of submitting the application

Regular employment insurance and the minimum necessary income requirement for 2020 taxation year

Under this public policy, all family class applicants’ sponsors (and co-signers, if applicable) who must meet income requirements will be able to count regular employment insurance benefits (which are normally subtracted) in their income calculations rather than just special employment insurance benefits for the 2020 taxation year. Regular employment insurance benefits are included in the Total Income line 15000 (formerly line 150) of the Notice of Assessment. The amount listed on line 13000 should not be excluded from eligible income for the 2020 taxation year.

Sponsors (and co-signers, if applicable) must to meet all other requirements of the Immigration and Refugee Protection Act (IRPA) and IRPR, except those for which an exemption is granted under this public policy. Not all sponsors need to meet income requirements. Further details about which sponsors need to meet income requirements can be found under the section Exception to minimum necessary income requirement.

Exception to minimum necessary income requirement

A sponsor does not have to meet MNI if they are sponsoring their spouse, common-law partner, conjugal partner, dependent child or a person under the age of 18 whom the sponsor intends to adopt in Canada [R133(4)]. However, in situations where an officer is of the opinion that the sponsor will be unable to provide adequate support and that the sponsored person will be unable or unwilling to support themselves and may have to rely on social assistance, the applicant may be found to be inadmissible for financial reasons [A39].

Parents and grandparents applications – Minimum necessary income assessment for the 2020 taxation year

The public policy allows foreign nationals applying for permanent residence as parents and grandparents to be exempted from the requirement for their sponsor to have the minimum necessary income (MNI) plus 30% for the 2020 taxation year, as long as the sponsor meets the MNI defined in section R2 and all other applicable requirements, including those pertaining to the other relevant taxation years. In other words, the public policy allows the principal applicant to be eligible for permanent residency even though their sponsor does not meet regulatory income requirements (as long as they meet the conditions outlined in the public policy for the 2020 taxation year).

All parents and grandparents applications where a financial assessment on the 2020 taxation year is required (for example, sponsors who submit their applications in 2021, 2022, and 2023) will benefit from the lower income requirement in this public policy. Sponsors (and co-signers, if applicable) still need to meet the MNI plus 30% for all other applicable taxation years, except for the 2020 taxation year.

For the 2020 taxation year, refer to the GCMS processing instructions below to determine whether the MNI has been met.

GCMS processing instructions

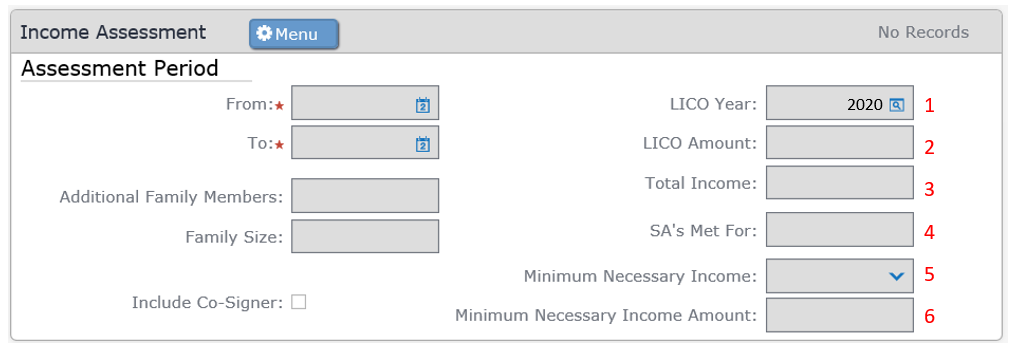

Under the “Sponsorship” tab and “FC Eligibility” sub tab, navigate to the “Income Assessment” sub screen in the tab.

The relevant GCMS fields are as follows (refer to the screenshot of the Income Assessment sub screen in GCMS):

- LICO Year: 2020

- LICO Amount

- Total Income: appears on line 15000 of the NOA or Option C printout

- SA’s Met For: family size

- Minimum Necessary Income: Met or Not Met

- Minimum Necessary Income Amount: (LICO + 30%)

Note: Prior to performing this assessment, the officer must ensure that all applicable income (including income under the Employment Insurance Act) for the sponsor (and co-signer, if applicable) is included in the 2020 taxation year. The instructions below do not apply to taxation years other than the 2020 taxation year.